- LIFT TRANSUNION CREDIT FREEZE FOR FREE

- LIFT TRANSUNION CREDIT FREEZE HOW TO

- LIFT TRANSUNION CREDIT FREEZE VERIFICATION

- LIFT TRANSUNION CREDIT FREEZE PASSWORD

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

LIFT TRANSUNION CREDIT FREEZE FOR FREE

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. You can also store your PINs in a notes app on your phone, a folder inside your desk or on an external hard drive.

LIFT TRANSUNION CREDIT FREEZE PASSWORD

Password managers such as LastPass, 1Password and Bitwarden are excellent choices for keeping your information secure and private. Storing your credit bureau PINs is much like storing passwords: keep them only where you can access them. If you lost your PIN, you can set up a new one by logging into your TransUnion account. If you’d rather unfreeze your credit over the phone, you will need your PIN. However, if you want to lift the freeze through your TransUnion online account, you won’t need to use your PIN you can simply log in to your account using your username and password. TransUnion requires you to create a six-digit PIN when you place a credit freeze. If you’d rather lift your freeze by phone, or have further questions about thawing your freeze, call Experian at 88.

LIFT TRANSUNION CREDIT FREEZE VERIFICATION

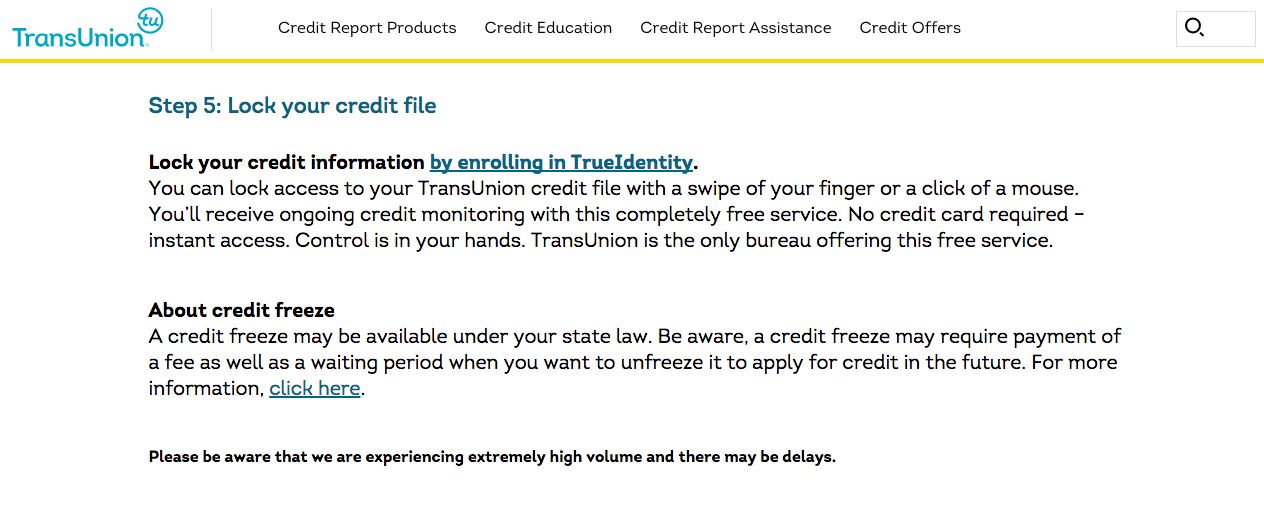

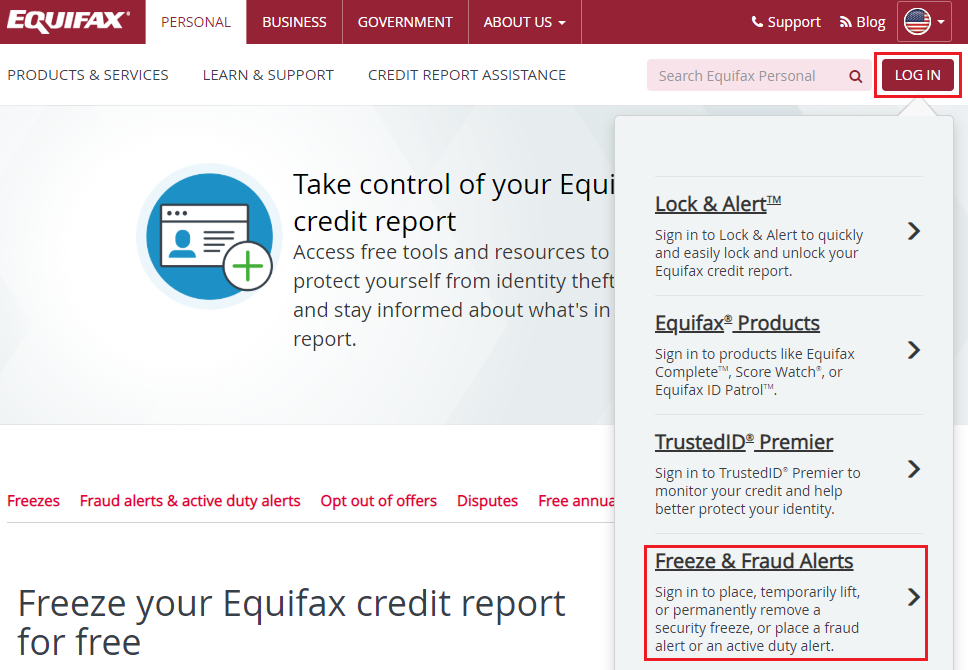

You should receive your PIN immediately if you provide the correct identity verification information If you lose your PIN, use Experian’s online PIN request form to have your PIN sent to you. You will need to use this PIN when you want to lift your credit freeze. Include copies of documents that confirm your identity, such as a utility bill or driver’s license, and request to unfreeze your credit.Įxperian will provide you with or you will create a five- to 10-digit PIN when you freeze your credit. Fill out a freeze request form and send it to Equifax. Once you’ve successfully answered a few basic identity-verification questions, they will be able to unfreeze your credit. Talk with an Equifax representative by calling 88. Once logged in, you can lift your credit freeze. Sign into your myEquifax account online using your username and password. There are three ways to thaw your credit freeze with Equifax without a PIN: If a PIN wasn’t established when you initially placed a freeze on your credit, Equifax won’t require a PIN to unlock your freeze. With an online myEquifax account, you can freeze and unfreeze your credit without a PIN.

LIFT TRANSUNION CREDIT FREEZE HOW TO

How to Unfreeze Credit Without a PINĪll three credit bureaus provide ways to help you lift your credit freeze if you’ve lost your PIN.

While TransUnion requires a PIN to unfreeze your credit over the phone, there may be ways you can unfreeze your credit with Equifax over the phone without a PIN.Įxperian is the only credit bureaus that requires a PIN to thaw a credit freeze regardless if you do it online, over the phone or by mail. The need for a PIN to unfreeze your credit depends on the specific credit bureau.īoth Equifax and TransUnion let you unfreeze your credit online without your PIN by entering your account username and password on their websites. When Is a PIN Necessary to Unfreeze Your Credit? Once you’re all set after your move, be sure to reinstate your credit freeze. Permanent lifts, with no specified end date, are best when you know your credit report will be checked by multiple entities, such as landlords and utility companies when you relocate. With temporary freezes, credit bureaus will automatically put a freeze back on your credit report after the designated time is up. This option is best if you’re applying for an auto loan, mortgage or credit card, as it provides enough time for banks and lenders to review your credit. A temporary lift can last between one and 30 days. There are two types of credit freeze lifts:

Whether you want to unfreeze your credit temporarily or permanently, there are ways to thaw your credit and allow banks and lenders to access your credit history. If you’re looking to unfreeze your credit but lost your PIN, don’t fret: TransUnion, Experian, and Equifax still make it possible to unfreeze your credit. But if you aren’t careful, you could forget the main tool needed to unfreeze it: your PIN. Freezing your credit is a smart idea that helps prevent identity theft.

0 kommentar(er)

0 kommentar(er)